Choosing the right startup exit timing

So, you're considering getting acquired. When should you pull the trigger?

Here are some important timing elements to consider:

- Good market conditions. Start by taking a look at NASDAQ or the S&P 500 and M&A in your sector. Are trends favorable?

- Strong metrics for the trailing 12-24 months. ARR chart high? Chart trending upward? Healthy balance sheet?

- The leadership team has no cracks in the armor, and people are here for the long run.

- Launched a game-changing feature recently? Seeing traction?

- Are you ready to part with your brainchild?

Let's dive a little deeper into these.

Market conditions matter

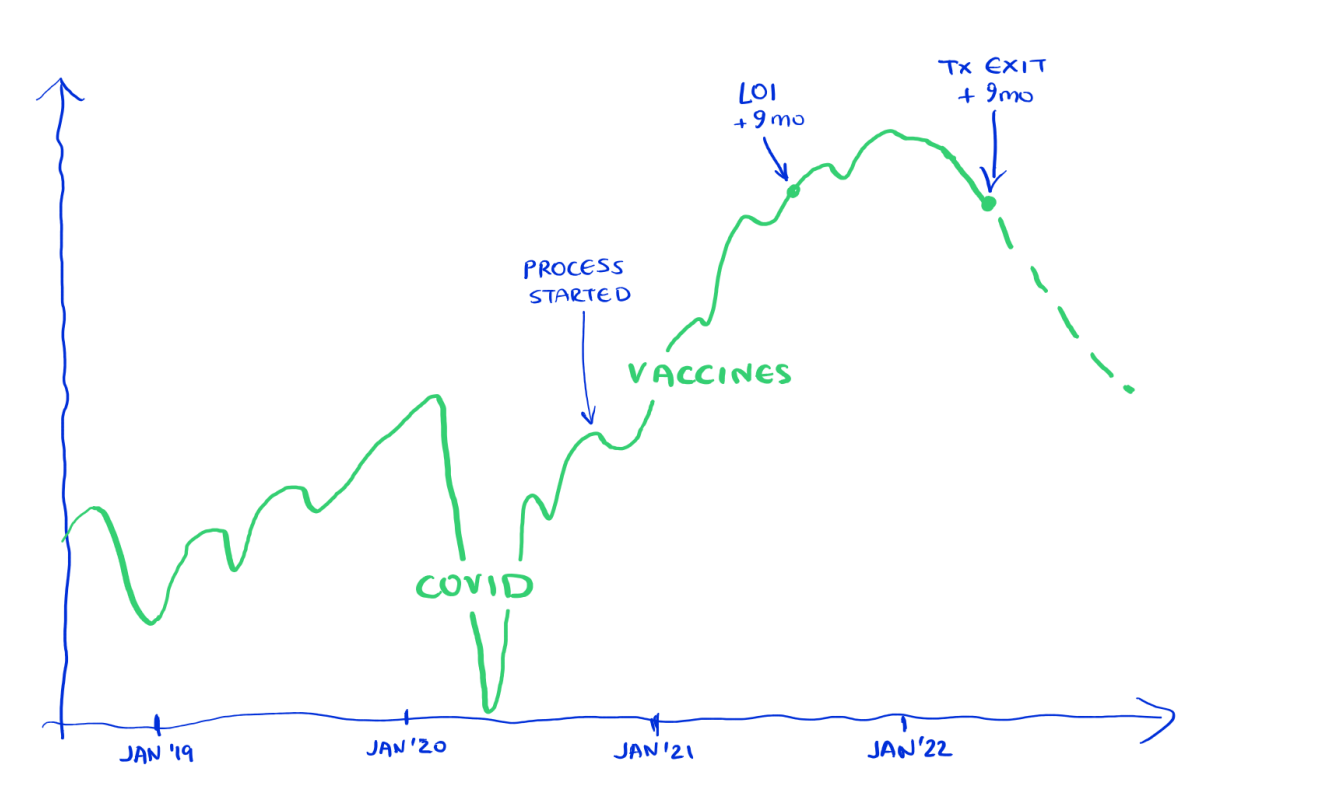

At Transifex, we decided to research M&A post-COVID-19's first wave. The market was shaky, and M&A was crawling. Buyers didn't know what was going to happen, and they were very shy about how aggressively they wanted to push their strategic goals.

On the other hand, our metrics were strong, even during the pandemic. Our team was very cohesive, seasoned, and fully committed, and we had just rolled out Transifex Native to select customers.

With the vaccine rollout, we felt the market would continue improving in the next few quarters. This would give us plenty of time to fully run our M&A research, learn from the market, further strengthen our metrics, and market our new, shiny product component.

We were right (and lucky, of course). 😉

Here's what I learned regarding market timing:

- Market trends are pivotal. Selling your company at a substantial multiple is significantly easier in a thriving, competitive market, especially if your sector is seeing a flurry of deals. In such a market, it's more probable to find similar companies that have sold at top dollar, and buyers to be adopting a more long-term, strategic outlook. Accelerate the process!

- Don't delay starting the process, even if market conditions aren't at their zenith. Exploring all avenues and engaging in plenty of meaningful conversations is a time-intensive process. Postponing until the market and M&A activities hit their stride could trap you in a cooling market during your due diligence.

- Proactively cultivate dialogues with strategic tech players. Is there a strategic buyer who is eyeing your company? What about their competitors? These talks take time to mature. Some key stakeholders see the potential immediately, while others... not so much.

- Summer is a challenging time to talk to buyers. Especially with strategic ones, since their process involves many internal stakeholders (product owners, VPs, Finance, Corp Dev) and it's difficult to align all of them when they have staggered time off for summer vacations.

Strong metrics

"Data beats emotions."

— Sean Rad, Tinder Founder

Metrics and M&A are a tricky combination.

When metrics tank, companies often face forced exits. Key employees lose faith and bail, the founder gets burnt out, and investors panic. Moreover, investors might be forced to put more money into the company at a bad valuation, which will further demoralize the team.

On the other hand, when metrics are strong, it's the best time both to exit and not to exit. You have optionality, and that's awesome.

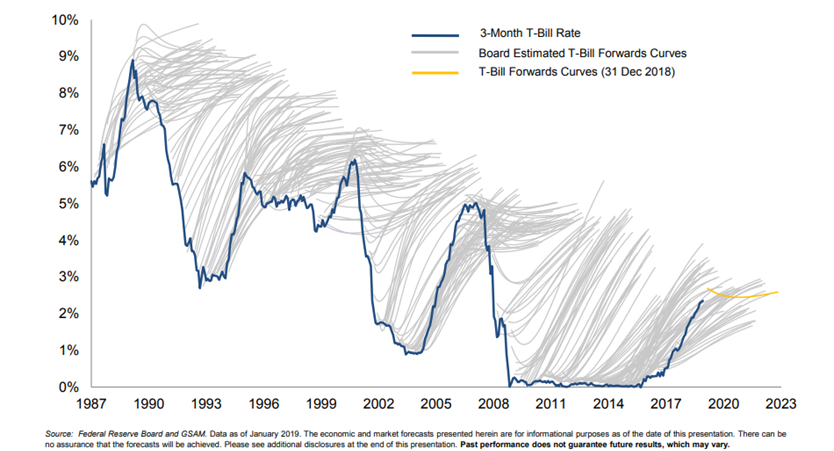

A word of caution here. When metrics are looking good, we often feel they will continue to look good. We really want it to happen, so we believe it will happen, even though we're no experts in market prediction. I've seen it again and again. Heck, even professionals whose job it is to forecast interest rates get it wrong and are almost always over-optimistic:

My advice? Start the process early, well before there is a chance things go south. Especially for teams that have been running the startup for many, many years and haven't taken meaningful money off the table. Worst case, you receive an offer and you decide to continue growing the company and to talk again in a few quarters' time.

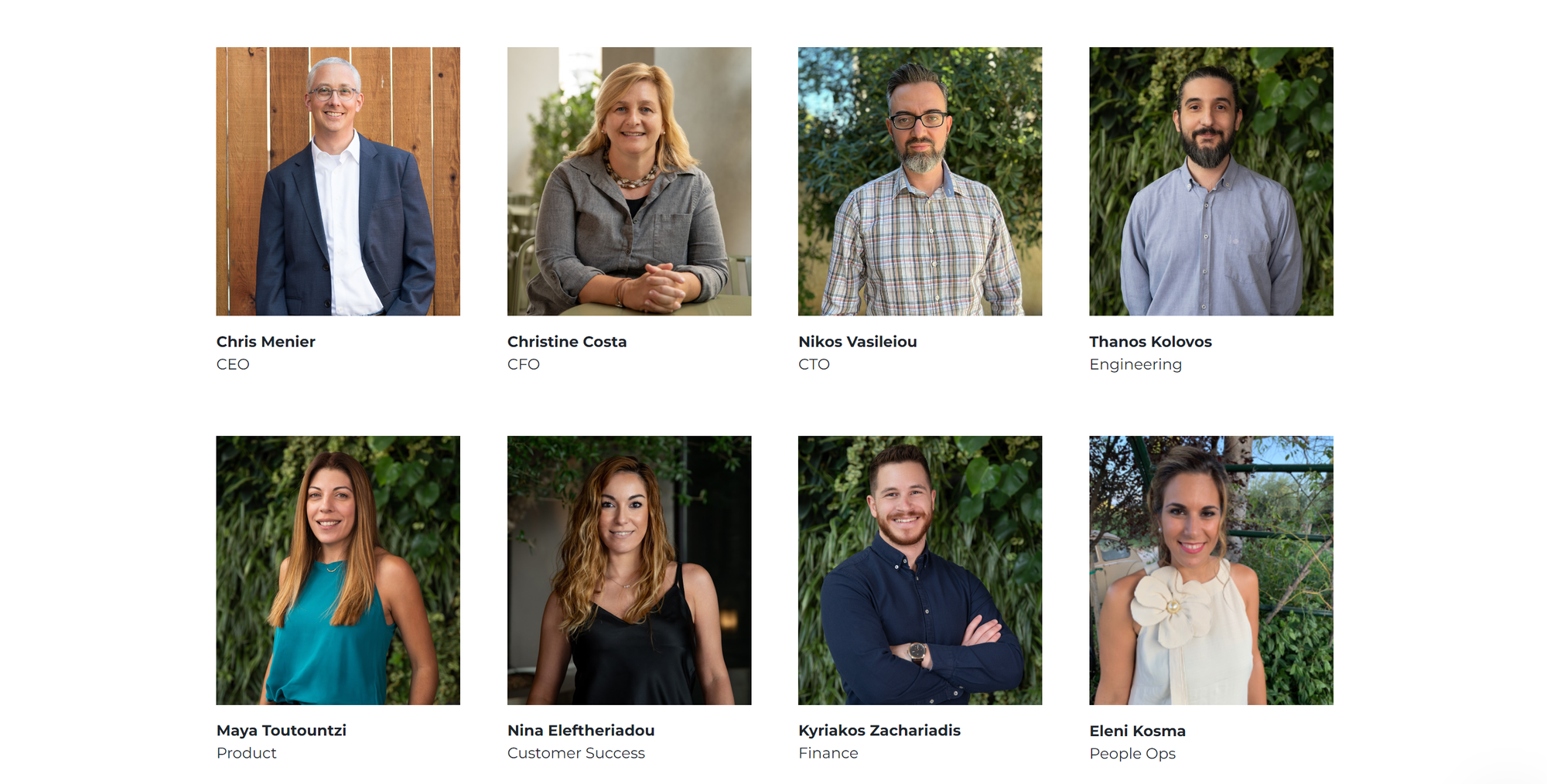

Stable leadership team

For most buyers, verifying that the startup they want to partner with has a stable, cohesive leadership team is one of the top priorities.

Here's what a cohesive team offers to the buyer:

- There are fewer things to worry about continuity post-acquisition. Company culture, vision, brand, reputation, and institutional knowledge are retained, which helps with maintaining morale and customer loyalty.

- It signals a lower risk of internal strife and power struggles, and the team is already equipped to steer the startup through the scaling and growth challenges that come post-acquisition.

- Members align swiftly with strategic goals and are faster with decision-making — both critical in the dynamic post-acquisition environment.

This was especially important for Transifex since part of the acquisition plan was that a new CEO would take over, and I would move on to new adventures.

Recent innovations

Transifex ran its M&A process around the moment that we rolled out Transifex Native, arguably the biggest innovation in software localization in the last decade. Customers were super psyched about this new technology, we had developers from large companies trying it out, and we were invited to big dev conferences to present it.

Launching major, strategic components or big partnerships and integrations further proves you're a market leader, helps explain how the company can continue its solid growth and become five times bigger, and creates buyer urgency. Now, if the recent innovation aligns perfectly with a buyer's strategic goals... it's gold.

Are you ready?

As a founder, are you at a place to part ways with your baby? Ah! This is a whole topic on its own. Lots to say about this in a separate story! 😄